Garage Repair Shop Insurance: A Smart Shield for Auto Businesses

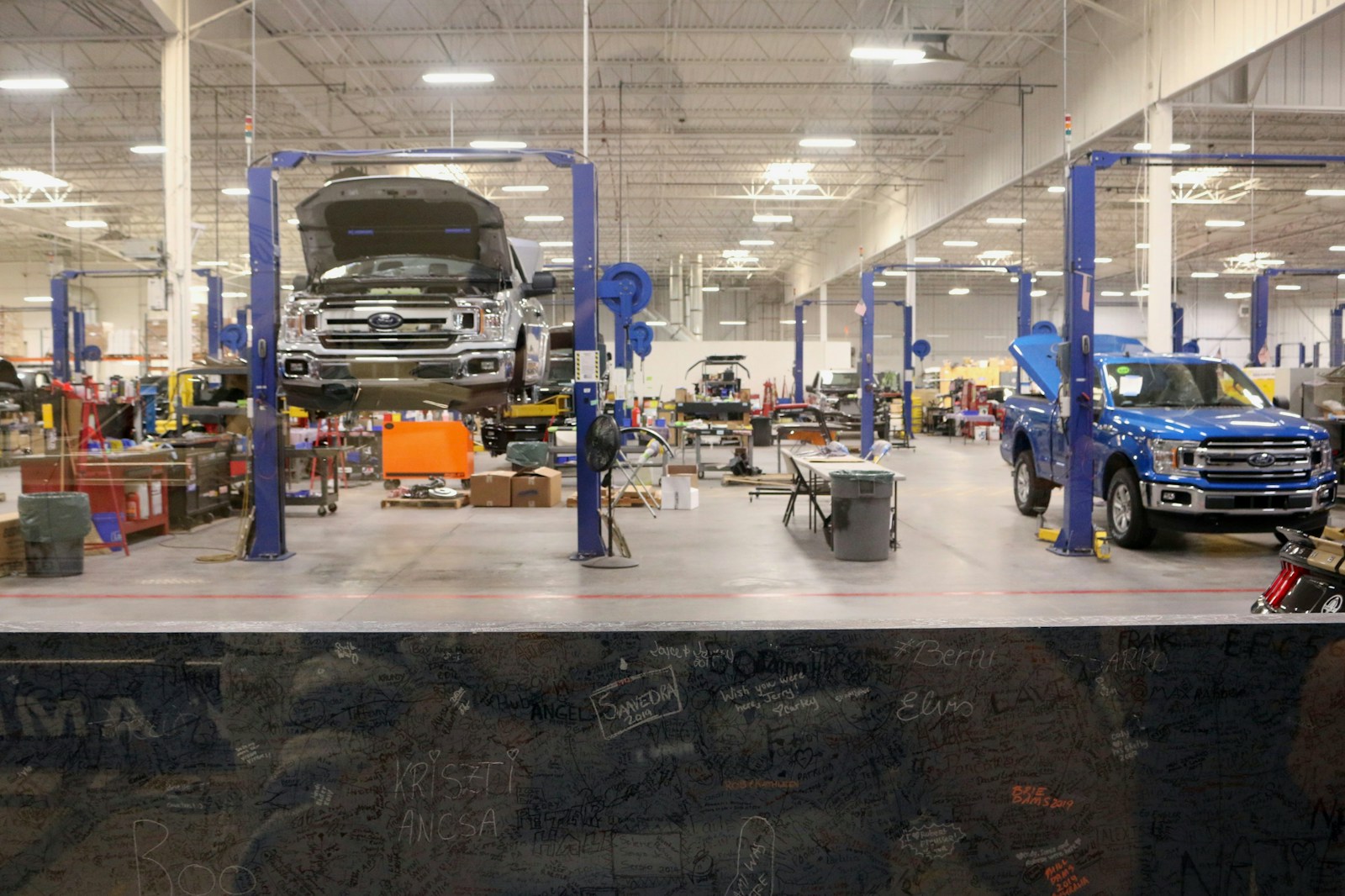

Running an auto repair business means not just fixing cars but also carrying out risks at all times. Tools, equipment, customer cars, and daily operations all have the risk of loss or damage unexpectedly occurring. Garage Repair Shop Insurance, which makes it possible for businesses to be ready for incidents like accidents, property damage, or liability claims. By having the right protection, can act knowing very well that their financial stability is not easily shaken by unexpected setbacks.

A well-structured insurance plan not only helps in the future but also allows the business to grow slowly and steadily, as it covers the risks that are peculiar to that particular industry, including Garage Insurance Coverage in Georgia. The protection provided goes as far as keeping the customer’s car safe while being serviced, as well as keeping the required equipment healthy. Thus, proper coverage reduces the tension and prevents major financial disruption. It also creates a bond of trust wherein the customers are made aware that their vehicles are in safehands.

How Garage Repair Shop Insurance Fits Real Garage Challenges

-

Coverage for Real Garage Risks

This protection is done in accordance with the daily workshop scenarios, it covers the usual risks like customer cars left for the night, accidental scratches while fixing the cars, tools getting broken, or fire breaking out unexpectedly, which are the major causes of business interruptions, to be protected.

-

Flexible Coverage for Expanding Shops

The risks of repair companies are directly linked to their growth. Their insurance options are crafted to be in step with the expansion, thus giving the client the freedom to have the coverage changed when new machinery is purchased, repair bays are extended, or recruitment is done, without interrupting the client’s operational or financial planning.

-

Proactive Protection, Not Reaction

The philosophy here is not to react to losses but to prevent them by being ready. When risks are controlled at the beginning, the garages will have less time losing their operations, be able to predict and manage costs that come as a surprise, and have an uninterrupted flow of work even in tough times.

-

Customer Trust and Professional Image

Distinct shielding creates trust among the customers who are willing to leave expensive cars at the garage. Insurance coverage for the car makes the customers even more trusting, helps in the formation of long relationships with them, and categorizes the garage as a service provider that is trustworthy, accountable, and professional.

Reliable Protection for Daily Operations

-

Uninterrupted Workflow Support

In case of everyday garage risks, such as unintentional breakage, customer car problems, or little accidents on-site, it has the feature of supporting the work without interruptions. This, in turn, enables the repair shops to carry out their duties without sudden financial strains or long downtimes.

-

Financial Pressure Relief

During unforeseen claims, it reduces the financial burden by covering the cost of repairs, liability, and even recovery, thus enabling the garage owner to tackle the problem with a calm mind and keep the business running.

-

Long-Term Business Stability

The company provides the owners with the power to maintain their long-term stability by letting them concentrate on customer service, quality repairs, staff management, and business growth while not constantly worrying about risks that might occur.

Why Choose D. Ward Insurance

D-Ward Insurance is the company that offers the best insurance services because it is already familiar with the local market and applies insurance in a way that is most suitable for the different businesses. This company does not offer, but rather gives practical coverages that are specifically made for the real operational risks and not for some arbitrary policies that are passed off as generic. The company stresses the importance of honesty, long-term relationships, and fast support, and thus, it becomes easier for the business owners to be well-informed.

In the automotive industry, which is constantly evolving, Garage Repair Shop Insurance is of utmost importance as it safeguards not only the daily activities but also the business goals for the future. When garage owners opt for a reliable insurance policy that is tailored to the actual dangers, they can then direct their attention towards the quality of service, gradual expansion, and building customer loyalty.

Categories: Auto Insurance